Fading "soft landing" with a long-short play

Should we expect a correlation regime change?

As you may suspect, I’m not buying the “Soft Landing” narrative. In my post “Don't fight Yellen?!”, I explained why I suspect that the Yellen team is running out of ammo.

But the play I’m suggesting here depends mostly on inflation. As you can see in the chart below, the correlation between stocks and bonds depends on the inflation regime.

During high inflation periods, stocks and bonds are positively correlated. And during low inflation periods, they are negatively correlated.

We are coming out of a high inflation period. So are stocks and bonds still correlated?

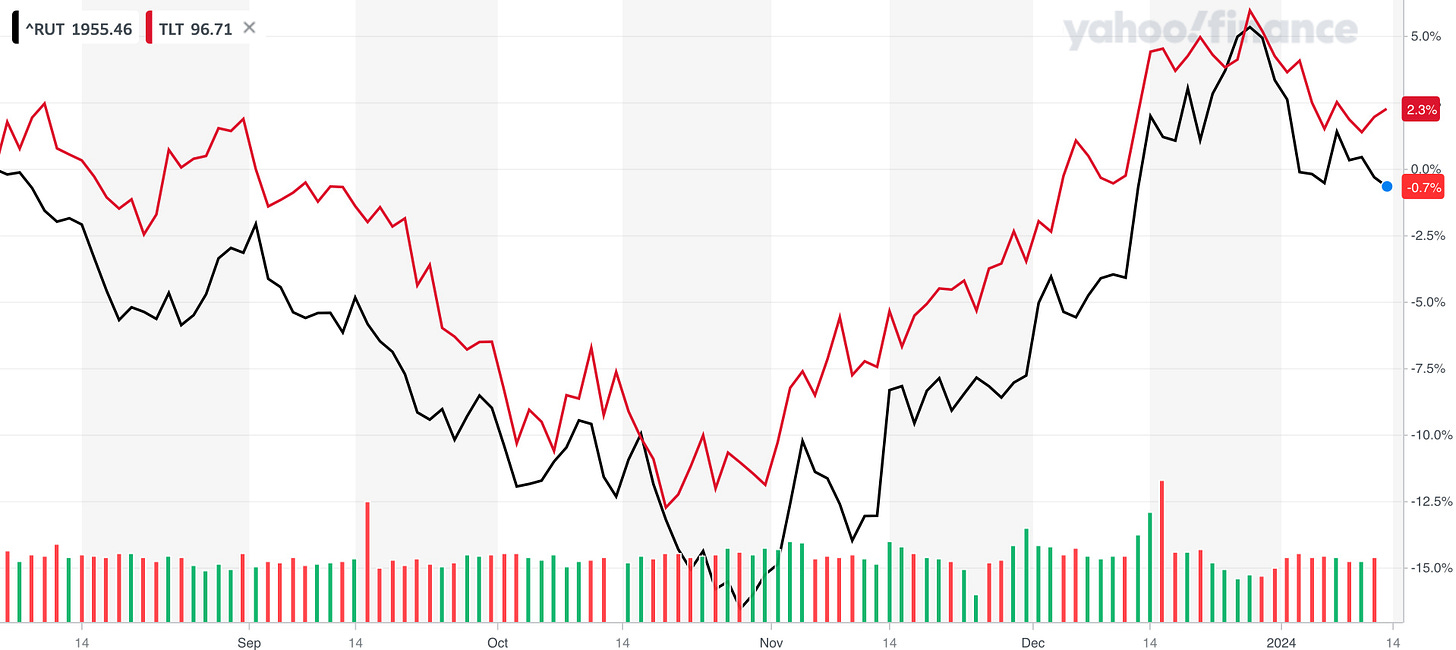

As you can see in the chart below, they have been correlated since August 2023.

Should we expect this correlation to break? According to the first chart, we should. Both the hard landing and soft landing narratives assume that inflation has been concurred for now.

If the correlation does break, which asset moves up and which down?!

It is hard for me to imagine a scenario where bonds crash, yields spike, and stocks run up at the same time. First, high yields depress stock valuations. Second, high yields occur in an inflationary regime. And we already observed that during high inflation, stocks and bonds are correlated. So if bonds crash, stocks crash.

I think it is safer to bet that if and when the correlation breaks, bonds would appreciate and stocks depreciate.

Keep reading with a 7-day free trial

Subscribe to Economic Defense to keep reading this post and get 7 days of free access to the full post archives.