In December we experienced a sudden Fed pivot. Within just a few weeks J. Powell went from “not thinking about rate cuts” to “expects to cut interest rates next year”.

This sudden move caused many investors to speculate on what has changed. Some suggested the election year as the motivation.

But what occurred to me was that the apparent “liquidity” in asset markets is at the expense of bank deposits. I speculated in “What is the Fed up to?” that the pivot was an attempt to bolster the banks. A new banking crisis might force the Fed to end its Quantitative Tightening (QT) program. And since the inflation aftermath of Covid, the focus of the Fed was on reversing Quantitative Easing (QE), also known as monetary debasement, which you can see in the following chart.

The Great Financial Crisis (GFC) brought us QEs of $3 trillion and Covid brought another $3 trillion. We went from a monetary base of $1 trillion in 2008 to $5.5 trillion now.

“Surprisingly” the Fed pivot produced the opposite of the desired result: more money leaving banks to chase stocks. The problem has been Financial Conditions that are too loose. That is what is causing money to chase stocks and create a new bubble.

Bank stabilization required tightening Financial Conditions, not loosening them.

It seems obvious that while the Fed has been hitting the breaks, Yellen has been pulling every trick to “spike the punchbowl”, push the “pedal to the metal” and so forth.

Consistent with these themes, the newly appointed Dallas Fed chief suggested that:

“Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run by smoothing redistribution and reducing the likelihood that we'd have to stop prematurely."

Basically we’re down to ending QT to save QT. Does it mean that the Fed “expects to cut interest rates next year” was not enough to save QT?!

Let me get this straight, despite the leading indicators signaling recession (as you can see in the chart below), we are in a “soft landing”.

The economy is doing great with record low unemployment and with Financial Conditions that are looser than a French “intimacy entrepreneur” but we need to reduce interest rates AND end QT?!

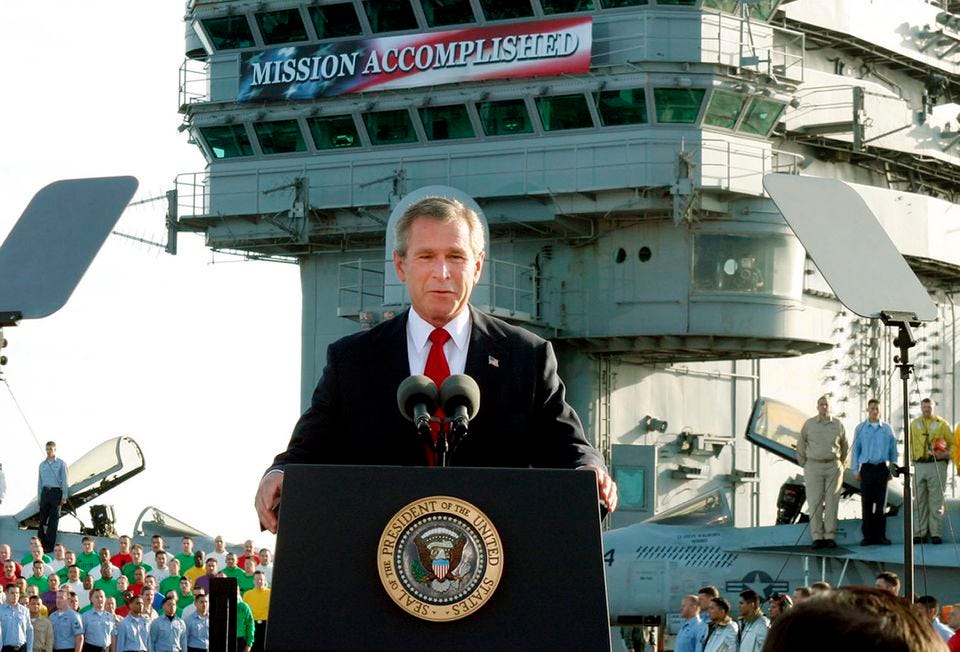

Mission Accomplished?